Small business employer payroll tax calculator

Only you as the employer will pay FUTA. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

How To Organize Your Taxes With A Printable Tax Planner Business Tax Deductions Expenses Printable Debt Calculator

Get Started With ADP Payroll.

. Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll. Get a free quote today.

Small Business Payroll Calculators 8 FREE payroll calculators for you and your employees If youre looking to calculate payroll for an employee or yourself youve come to the right place. Hourly employee paycheck calculator If youre trying to calculate hourly wages not salaried wages use our hourly paycheck calculator instead. Get Started For Free.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad Payroll So Easy You Can Set It Up Run It Yourself. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022.

The Texas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Texas State Income. IRS is offering coronavirus relief to taxpayers and many businesses will qualify for two tax credits - the Credit for Sick and Family Leave and the Employee. Be sure that your employee has given you a completed.

The best For Startup Companies. Tyler and Company is a full service tax accounting and business consulting firm located in Logan UT. Free Unbiased Reviews Top Picks.

Ad Compare This Years Top 5 Free Payroll Software. TriNet provides small and medium size businesses SMBs with full-service HR and payroll solutions tailored by industry. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Designed for small business ezPaycheck is easy-to-use and flexible. How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

The maximum an employee will pay in 2022 is 911400. 2 Prepare your FICA taxes Medicare and Social Security monthly or semi. This form aims to calculate the payroll tax depending on the marital status of an employee and the number of dependants.

All Services Backed by Tax Guarantee. Upgrade Reduce Costs with the Best Payroll Services. The calculator includes options for estimating Federal Social Security and Medicare Tax.

The FUTA tax rate is 6 but most employers receive a credit of up to 54 when Form 940 is filed. Payroll Tax Calculator for Businesses GTM provides this free business payroll tax calculator and overtime calculator to help you find out what your companys employees taxes standard. Ad Accurate Payroll With Personalized Customer Service.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Find The Best Payroll Services For Your Small Business. It only takes a few seconds to.

The FUTA wage base is 7000 per employee per year. Calculate Federal Unemployment Tax Act FUTA withholding each pay period. All inclusive payroll processing services for small businesses.

Get a free quote today. If Aaron is your only employee you would owe FUTA tax in the amount of. Calculate Tax Print check File tax form W2 W3 940 941 Free Trial.

Ad PSI Payroll - making sure your people are paid accurately compliantly and on-time. You simply multiply an employees gross wage payment by the applicable tax rate to determine how much you must withhold and how much you must pay as the employer. Payroll administration is a burden to small companies and at the.

So if a cardholder leaves his magnetic stripe payment card. If youre looking for complete peace of mind with your payroll we are here to help. Get Started With ADP Payroll.

Editable Time Log Work Log Template Work Log Time Log Etsy In 2022 Time Sheet Printable Timesheet Template Starting Small Business

Did You Know That Recent Tax Laws Allow You To Deduct The Entire Amount Of Interest From Any Mortgage Loans You Take Out Wh In 2022 Tax Refund Mortgage Loans Mortgage

Pin Page

How And What To Deduct During Business Travel The Accountants For Creatives Small Business Tax Deductions Creative Small Business Business Finance Management

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Template Free Templates

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll

Calculate Payroll In Your Organization Using Only Microsoft Excel Excel Tutorials Excel Templates Payroll Template

Easy To Use Payroll Software For Small Businesses Ezpaycheck Payroll Software Payroll Taxes Payroll

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Payroll Checks

The Self Employment Tax Explained By A Self Employed Cpa Self Employment Employment Tax Help

3 Simple Ways To Reduce Your Taxable Income The Accountants For Creatives Small Business Tax Deductions Business Tax Deductions Small Business Tax

Self Employment Tax Calculator For 2021 Good Money Sense Self Employment Business Tax Deductions Small Business Tax

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Employer Identification Number

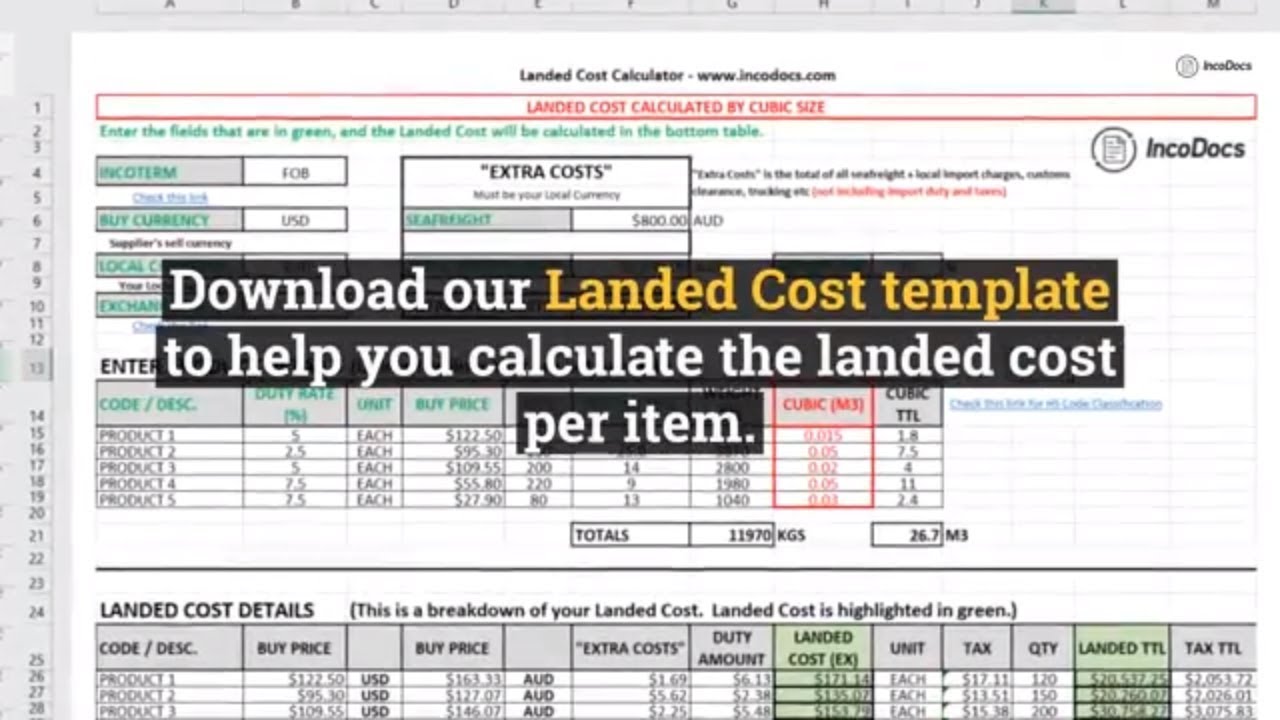

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

How To Set Your Salary As A Business Owner Payroll Taxes Payroll Hiring Employees

Managing Payroll For Small Business Owners Bookkeeping Business Small Business Bookkeeping Small Business Organization